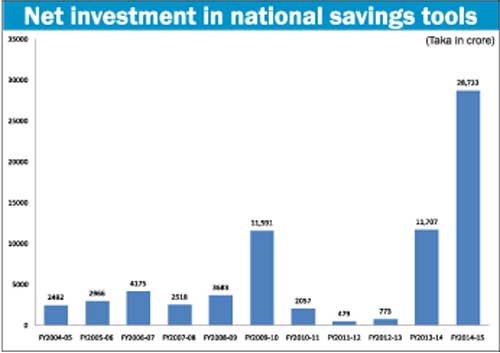

Investment in savings tools sets record at Tk 28,733cr in FY15

The net investment in the national savings certificates and bonds hit a new record at Tk 28,732.64 crore in the last financial year as clients continued to invest heavily in the tools in June despite interest rate cut by the government in late May.

According to the latest Directorate of National Savings data, the net investment in the savings instruments increased by 145.42 per cent to Tk 28,732.64 crore in the FY 2014-15 compared with that of Tk 11,707.31 crore in the same period of the FY 2013-14.

The previous highest of the net investment in the savings tools was Tk 11,707.31 crore in the FY14, but a Tk 13,135-crore net investment in the first half of the FY15 had broken the record.

The net investment in the NSCs crossed its annual target in just four months in the FY15 as the figure stood at Tk 9,077.60 crore in the period against the fiscal year’s target of Tk 9,056 crore.

Due to the surge in investment in the NSCs, the government on May 23 cut the rate of interest by around 2 per cent on its different savings tools to contain the trend, a DNS official told New Age on Sunday.

The government faced pressure of interest payment to the clients who invested in the NSCs in recent years as the interest rate for the savings tools was between 12.59 per cent and 13.45 per cent before the latest rate cut, he said.

Despite the rate cut by the government, the clients continued to invest heavily in the tools as the interest rate for the savings certificates and bonds was still much higher than that of the banks’ deposit products.

Banks now offer maximum 7 per cent to 8 per cent interest to their clients for the fixed deposit schemes.

The net investment in the saving tools, however, dropped slightly to Tk 2,170.20 crore in June against Tk 2,433.95 crore in May of the FY15.

The DNS official said the government had expected that the net investment in the savings tools would decrease massively in June.

He, however, said that the recent upward trend in the net investment might not affect the government’s interest payment to the clients, who invested in the tools, as its (government) borrowing from the banking sources might increase in this financial year.

The latest DNS data showed that savings instruments worth Tk 42,659.78 crore were sold through banks, national savings bureaus and post offices in the FY15 against Tk 24,309.60 crore in the FY14.

A BB official told New Age on Sunday that the government had not taken any loan from the banking sources in the FY15 whereas it paid back Tk 6,869 crore in the period to banks due to the surge in the net investment in the savings tools.

- See more at: http://newagebd.net/143394/investment-in-savings-tools-sets-record-at-tk-28733cr-in-fy15/#sthash.VuA50vBu.dpuf