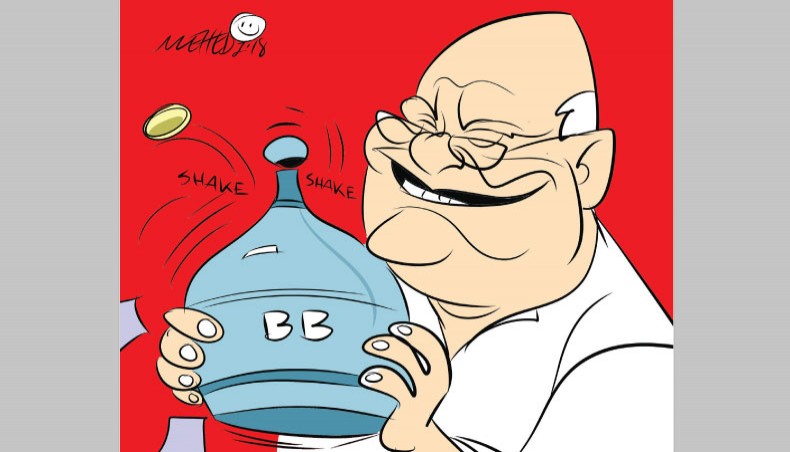

PRIVATE BANKS CRR to decrease, govt deposit to increase

The government on Sunday decided that the mandatory cash reserve requirement of commercial banks would be reduced to 5.5 per cent of their deposits from the existing 6.5 per cent and state agencies would deposit 50 per cent of their funds instead of the existing 25 per cent, in private banks.

Finance minister AMA Muhith disclosed the decisions made following demands from Bangladesh Association of Banks while experts said that the decisions contradicted Bangladesh Bank’s policy on credit and would create scopes for more loan scams and capital flight in the crucial election year.

Muhith made the disclosure while talking to reporters after a ‘follow-up’ meeting with the association of private bank owners at a city hotel.

Bangladesh Bank governor Fazle Kabir, prime minister’s privatisation affairs adviser Salman F Rahman and association representatives, including its chairman Md Nazrul Islam Mazumder, were present during the announcement.

Muhith said that Salman F Rahman insisted on the cash reserve requirement which would be reviewed in June.

Earlier on Friday, the association asked the finance minister to meet the demands on pretext of liquidity crisis in the banking sector at a meeting at an alternative venue, Jabbar Tower at Gulshan-1 instead of the scheduled venue, Hotel Sonargaon, following the demand by association leaders.

Experts noted that the association’s claim of liquidity crisis was not correct as there was enough liquidity in banks except a few like Farmers Bank which failed to repay more than Tk 852 crore of deposits to the clients because of loan scams.

They said that the central bank was struggling as the private sector credit growth was hovering around 18 per cent against the target of 16 per cent in December 2017.

The experts noted that the decision to cut the cash reserve requirement by 1 percentage point would increase flow of money by Tk 10,000 crore in the money market and would have multiplying impacts.

Former interim government adviser Mirza Azizul Islam said that the additional money would be invested in unproductive sector in the election year and smuggled out of the country.

Washington-based Global Financial Integrity in its report released on May 1, 2017 said that illicit capital flight from Bangladesh was on the rise from 2007 and continued until 2013 when the highest $9.66 billion was siphoned off.

Former central bank governor Salehuddin Ahmed doubted if the central bank was given chance for adequate analysis before cutting the cash reserve requirement, which, according to him, was an effective tool for the central bank to protect the depositors’ interest.

He noted that the central bank weakened the safeguard by slashing the cash reserve requirement.

The experts said that the government decision to deposit 50 per cent of the state agencies’ funds in private banks would lead many state agencies into crisis, as faced by environment ministry and Bangladesh Telecom Regulatory Commission because of Farmers Bank’s failure to repay their deposits.

Former Bangladesh Bank deputy governor Ibrahim Khaled said that there should be no mandatory lowest limit for state-owned agencies for keeping deposit in private banks.

The state-run agencies should be given scope to increase their deposit in the private banks on condition of bank-client relationship to be monitored properly by the central bank, he said.

Bangladesh Institute of Bank Management director general Toufic Ahmad Choudhury said that the demands by the association of banks were nothing but to exploit the government again ahead of the next general election.

In January, the government in parliament passed a bill, pursued by the association, enabling four members of a family, instead of two, to be directors of a bank and hold the post of directors for three consecutive terms or nine years instead of six years.

News Courtesy: www.newagebd.net