Remittance drops below $15b-mark

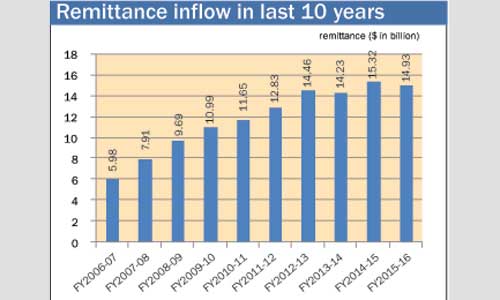

The country’s inward remittance decreased by 2.55 per cent year-on-year dropping below US$ 15 billion in the just concluded fiscal year 2015-16 due mainly to declining trend in the global oil price.

According to the Bangladesh Bank data released on Monday, remittance inflow in FY16 decreased to US$ 14.92 billion from US$ 15.31 billion in FY15. The remittance inflow stood at US$ 14.22 billion in FY14 and US$ 14.46 billion in FY13.

Former interim administration finance adviser AB Mirza Azizul Islam told New Age on Monday that global oil price slump was a reason behind the downtrend in remittance inflow, as the lion’s share of Bangladesh’s remittance earning comes from the Middle East countries which are most influenced by oil price movement.

The majority of Bangladeshi expatriate workers are now working in the Middle East countries and the economies of that region mainly depend on the income received from petroleum products, he said.

The lower prices of petroleum products have hit the business in the Middle East, resulting in squeezing of their spending, he said.

The government has no statistics of what number of workers is now being forced to come back to the country due to economic crisis in the Middle East, he said.

He said, ‘The expatriate Bangladeshis, who are now working in different countries of Middle East, may also face salary cut which ultimately put an adverse impact on the inward remittances’.

The government should investigate in this regard, he pointed out.

The gap of exchange rate between the central bank and scheduled banks is another cause of declining trend in the inward remittance, he said.

The decreased trend in inward remittance will hit the consumption demand of lower-middle class and lower class people as majority number of the workers went abroad from those sections, he said.

He said, ‘The inward remittance has been playing a significant role in eradicating poverty line for the last few years. But the situation will deteriorate due to the decreasing trend in the remittance.’

A BB official said that the currency exchange rate of United Kingdom, Singapore and Malaysia against greenback had depreciated in the recent months which also put a negative impact on the inward remittance.

The BB data, however, showed that the inward remittance increased by 1.62 per cent to US$ 1.46 billion in June from US$ 1.43 billion in the same month a fiscal year ago due to Eid-ul-Fitr, which was celebrated on June 7.

The expatriate Bangladeshis usually send good amount of greenback to their near and dear ones on the occasion of Eid-ul-Fitr, which is one of the biggest religious festivals for Muslims.

According to the BB data, in June, the private commercial banks received US$ 985.10 million in inward remittance, while the state-run commercial banks received US$ 448.21 million, foreign commercial banks US$ 15.49 million, and specialised development banks US$ 13.89 million.

In June, Islami Bank Bangladesh received the highest amount of remittance of US$ 343.92 million among the private commercial banks, while Agrani Bank got the highest amount of US$ 163.18 million among the state-run banks.

News Courtesy: www.newagebd.net